Every business should keep up with its financials. Making sure you have control over your accounts and money flowing into the small company’s bank account is crucial to the survival of your business. So, how do you manage your bookkeeping for your small-scale company? It is possible to utilize software, but a lot of accounting software comes with a steep learning curve and is costly.

For small-scale businesses that are short in funds, you need to maximize the value of your buck. What is an entrepreneur of small size can do to manage its finances without costing the bank?

The answer? Xero accounting software!

If a small company wants to handle accounting tasks, Xero is accounting software that is cloud-based and designed specifically for small-sized companies. Learn more about the reasons behind the Xero Accounting Software the best choice for small businesses as compared to other accounting software.

What is Xero Accounting Software?

Xero was established in 2006 by Rod Drury and Hamish Edwards in Wellington, New Zealand. The initial name was Accounting 2.0. By 2020, the firm has more than 2 million global customers and a market capitalization of more than PS10 billion. Xero is a completely cloud-based accounting program for medium and small-sized businesses.

It is possible to perform bookkeeping tasks such as invoicing, recording invoices Bank reconciliations and VAT returns including MTD returns as well as payroll. You can link directly to your account at a bank via Xeroand feed it into your bank. Xero can be used for cash-based as well as accrual accounting systems, and so it’s ideal for businesses that adhere the UK GAAP or IFRS.

What makes Xero a good choice?

Many business owners are pleased that the Xero user interface is user-friendly and simple to use. Because Xero is fully Cloud-based software, you can access it from any place you’d like, at any time you need, and not be tied to one PC. Xero Accounting Software can be used via your smartphone and doesn’t require any IT maintenance or installation of software.

For a start with Xero, all you must do is sign up for the monthly plan that meets the requirements of your small-scale business. then enter your username as well as password. Anything you add or modify can also be seen by other users once you include them in the users’ list.

- A Clear Business snapshots

One of the best advantages that come with Xero is software gives you the financial information of your company on one screen: A business overview. You can access this report here: Accounting>Reports>Financials>Business snapshot. The Business Snapshot is the most crucial financial report for you if you’re a company owner or an important decision-maker. It is also the least used Xero report. An image can be worth more than a thousand words. There are five charts in one screen: efficiency, profitability financial performance, financial position, income, and expenses. It also shows the time it takes to get cash and the time required for you to repay your debtors. This way you can calculate your company’s cash flow cycle! Once you have completed your bookkeeping, you should be reviewing your account at least per month.

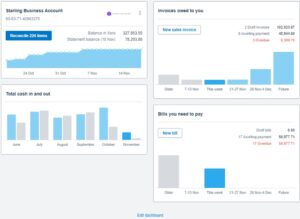

- Xero dashboard

The dashboard on Xero gives you quick access to the most important aspects of your company’s account and also gives you the overall picture of costs, bank balances creditors, and debtors.

The dashboard is the default landing page however did you know that you can customize what to include on your Xero dashboard?

What does Xero Dashboard include?

- Bank accounts- it lists all the bank account connected with Xero

- Cash in and out – a Histogram of cash in and cash out

- VAT return- this will show how many days before a return is due

- Account watchlist- list of individual ledger codes selected to view here

- Invoices owed to you- Unpaid invoices

- Bills you need to pay- Unpaid bills

- Expense claims- expense claims launched by employees

You will find a customize option at the bottom of the page to customize the information to your liking by arranging the different cards around. This will make a more personalized experience. Xero can be customized to suit the requirements of your business perfectly.

- Use Hubdoc

Xero has completed the purchase of HUBDOC which is a tool for data capture in the year 2018. It is available in all business editions, free of cost.

Hubdoc works perfectly with Xero flawlessly.

HUBDOC also has an application. It is now possible to scan receipts or bills as well as it’s Optical Character Recognition (OCR) will instantly retrieve all pertinent information. This reduces the time spent on accounting and decreases the chance of making mistakes.

In this method, HUBDOC is also an additional control layer first, you verify your data in Hubdoc as well as you check in Xero.

Xero payroll feature allows you to monitor, manage and process employees’ pay and pensions all in one location.

Xero also gives access to employees to make online requests for leave and submit timesheets.

In addition, you can manage and alter every aspect of your pension and payroll by using the Xero payroll. The data can be directly sent via email to HMRC or pension authorities through the system, thus removing another task from your “to-do” list.

How can Xero help run your small business?

Once you’ve got your feeds from banks functioning and you’ve reconciled your transactions, you’re now ready to look at all the reports you can access.

The following reports provide an overview of the reports available:

- Balance sheet

- Profit & loss

- Summary of cash

- Transactions on the account

- Budget Manager

- Cash flow statement

Most Xero reports are fully customizable features that allow the user to run a report in a matter of seconds, for any time you require.

All reports are printable and are exportable to PDF, Excel or Google Sheets.

Final Thought:

With all the features mentioned, Xero accounting software has made bookkeeping and accounting easy for small-sized companies. These features can give your small business an advantage over the competition in a marketplace that has half of the small companies fail within the initial four years.

In the end, Xero is a very simple to use, flexible accounting program which can adapt to the needs of your company needs. It is possible to make it easier to prepare reports and tax returns by granting an accountant access to company accounts using Xero.