At FineX Outsourcing, we specialize in providing accounting outsourcing services to UK firms and business, helping them streamline operations, cut costs, and enhance efficiency. Many accounting firms face challenges such as staff shortages, increasing workloads, and accuracy issues, especially during peak tax seasons. Our expert back-office support enables them to overcome these obstacles while maintaining high service quality.

In this success story, we showcase how one of our clients transformed their accounting practice by outsourcing their bookkeeping, payroll, and tax preparation functions to FineX Outsourcing.

The Challenge: Managing High Workloads & Ensuring Accuracy

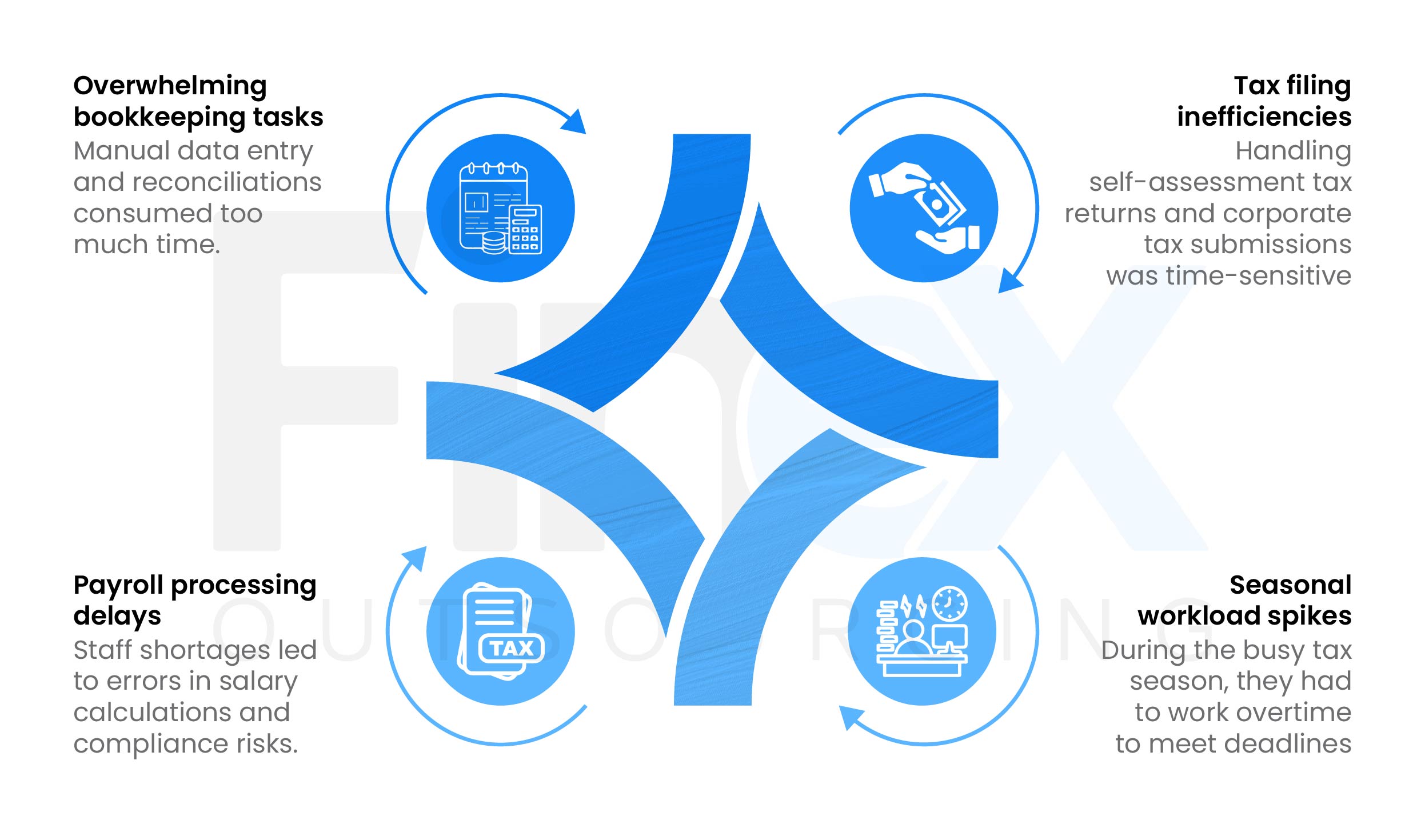

A mid-sized UK-based accounting firm approached us with concerns about managing their growing client base while maintaining accuracy and efficiency. Their in-house team was struggling with:

- Overwhelming bookkeeping tasks – Manual data entry and reconciliations consumed too much time.

- Payroll processing delays – Staff shortages led to errors in salary calculations and compliance risks.

- Tax filing inefficiencies – Handling self-assessment tax returns and corporate tax submissions was time-sensitive, but their team lacked the bandwidth to manage it effectively.

- Seasonal workload spikes – During the busy tax season, they had to work overtime to meet deadlines, resulting in burnout and errors.

With increasing operational demands and limited resources, they needed a cost-effective solution that would enhance productivity without compromising quality.

The Solution: Expert Back-Office Support from FineX Outsourcing

After a thorough consultation, we designed a tailored outsourcing solution that aligned with their business goals. Our approach included:

1. Efficient Bookkeeping & Payroll Processing

We took over their day-to-day bookkeeping tasks, including:

✔ Data entry & bank reconciliations – Automating financial transactions to minimize errors.

✔ Accounts payable & receivable management – Ensuring invoices and payments were processed on time.

✔ Payroll processing – Managing salaries, tax deductions, and compliance requirements.

2. Tax Return Preparation & Compliance Support

Tax filing is a critical responsibility for accounting firms, and our client was struggling to keep up with deadlines and compliance regulations. Our team provided:

✔ Self-assessment tax return preparation – Organizing financial data and ensuring accurate tax submissions.

✔ VAT return filing & advisory – Helping them meet regulatory requirements efficiently.

✔ Corporate tax preparation – Handling tax calculations and compliance for their clients.

3. Scalable Support During Peak Seasons

To manage seasonal workload spikes, we allocated additional resources during high-demand periods. This helped them:

✔ Meet strict filing deadlines without overburdening their in-house team.

✔ Maintain service quality without compromising on accuracy.

✔ Avoid staff burnout while ensuring consistent client satisfaction.

Your Top Outsourcing Questions Answered

As we step into 2025, many accounting firms are exploring how outsourcing can help them navigate challenges and seize opportunities. Here are answers to some of the most pressing questions we’ve received in 2024:

1. What are the immediate financial benefits of outsourcing for accounting firms?

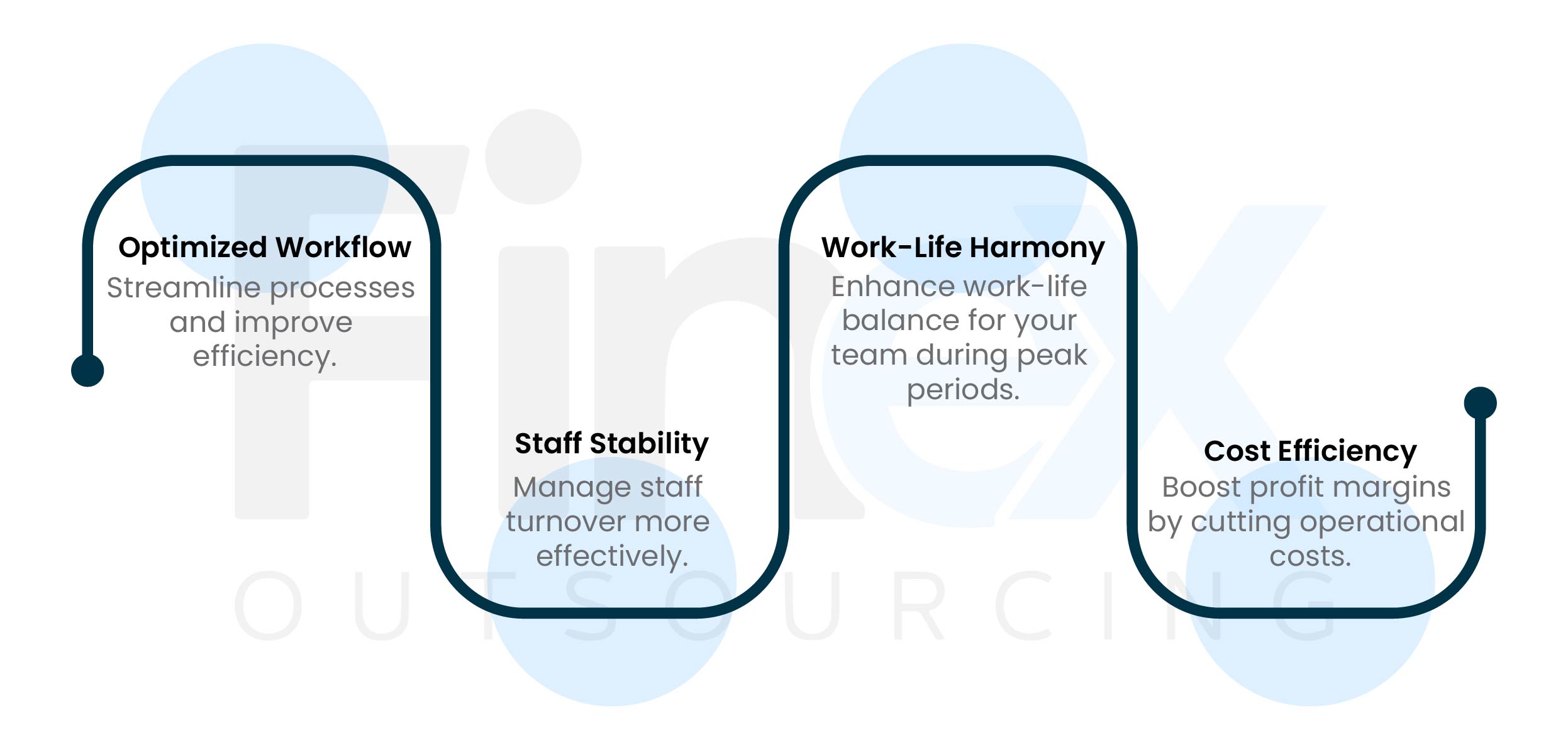

Outsourcing is a proven strategy to reduce costs while maintaining—or even enhancing—service quality. By delegating routine tasks like payroll, tax preparation, and compliance, firms can:

- Streamline processes and improve efficiency.

- Manage staff turnover more effectively.

- Enhance work-life balance for your team during peak periods.

- Boost profit margins by cutting operational costs.

2. How does outsourcing help in managing compliance and reducing errors during tax season?

At Finex Outsourcing, we take compliance seriously. Our rigorous process management ensures accuracy and reliability:

- Comprehensive checklists and double-tier review systems minimize errors.

- Last season, we handled over 5,000 self-assessments with a near-zero error rate and 100% compliance.

- Our proactive approach ensures your firm stays ahead of regulatory changes.

3. In what ways can outsourcing improve client relationships?

Outsourcing isn’t just about cutting costs—it’s about creating value. By partnering with Finex, your firm can:

- Focus on high-value activities like client advisory and business development.

- Dedicate more time to strategic client engagement and retention.

- Deliver faster, more accurate services, enhancing client satisfaction.

4. What should firms consider when choosing an outsourcing partner?

Choosing the right partner is critical. Here’s what to prioritize:

- GDPR compliance and ISO 27001 certification to ensure data security.

- A proven track record of service quality and reliability.

- Transparent communication and a commitment to long-term partnerships.

The Results: Enhanced Efficiency & Cost Savings

By outsourcing their back-office functions to FineX Outsourcing, the firm achieved significant improvements in efficiency, accuracy, and cost-effectiveness.

🔹 40% Reduction in Operational Costs – With a dedicated offshore team handling their back-office tasks, they eliminated the need for hiring additional in-house staff, resulting in major cost savings.

🔹 95% Increase in Data Accuracy – By leveraging our advanced bookkeeping and payroll solutions, the firm saw a drastic reduction in manual errors and reconciliation issues.

🔹 Faster Turnaround Times – Our experts helped streamline their workflow, ensuring quicker tax return processing and faster financial reporting for their clients.

🔹 Improved Client Satisfaction – The firm’s clients noticed an improvement in service quality, as financial statements and payroll processing were completed accurately and on time.

🔹 More Focus on Advisory Services – With bookkeeping and compliance tasks outsourced, the firm’s partners had more time to focus on business growth, client advisory, and strategic financial planning.

Why Accounting Firms Choose FineX Outsourcing

Our client is just one of many accounting firms that have benefited from our outsourcing solutions. By partnering with FineX Outsourcing, firms gain:

Access to Skilled Accounting Professionals – Our experienced team is well-versed in UK accounting regulations and compliance requirements.

Scalability & Flexibility – Whether you need support during peak seasons or ongoing back-office management, our services adapt to your business needs.

Cost-Effective Solutions – Save on overhead costs without compromising service quality.

Advanced Technology & Secure Processes – We use the latest cloud accounting software and ensure data security compliance.

Transform Your Accounting Firm with FineX Outsourcing

If you’re an accounting firm looking to optimize operations, reduce costs, and improve efficiency, outsourcing your back-office functions can be a game-changer. At FineX Outsourcing, we provide end-to-end solutions for bookkeeping, payroll, tax support, and audit outsourcing—tailored to meet the unique needs of your firm.

Get in touch today to discover how we can support your firm and help you achieve the same results!