Any unused personal allowance cannot be carried backwards or forward to a different tax year. Understanding how personal allowance can reduce the overall taxable income may appear complicated.

Do I always need to pay tax on my earnings?

Tax-free allowances reduce your tax liability. You have to pay on your earnings.

There are two types:

- Allowances let you earn the maximum amount you can earn up to specific amount without having to pay taxes

- Tax relief is a tool you can take advantage of to lower your tax bill in total.

What is an individual allowance?

It is how much money you could earn in each tax year prior to paying tax on income.

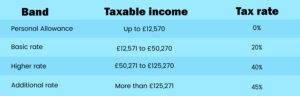

Your Personal Allowance (£ 12,570) for tax year 2022-2023 will be £ 12,570. In general, you will not owe any tax on your income in the event that your income is less than the threshold.

If you’re applying for the Marriage Allowance as well as Blind Person’s Allowance and you are eligible, your personal Allowance could increase or decrease when you earn a substantial income or have tax obligations from the previous year.

What is the typical individual tax exemption?

In 2022-2023, the personal tax allowance standard amount is £ 12570.

Any additional money that you earn will be tax-deductible. The amount of tax a person has to must pay after the personal allowance will depend on how they make during an income tax year.

For example, if your annual income is

If you exceed £ 100,000, the base personal allowance is reduced by £1 for every £ 2 you exceed the £ 100,000 limit. This is regardless of your age.

If your tax issues are slightly more complex, for example, when you’re a member of a civil partnership , or married and are entitled to an allowance for marriage or the reasons of income or age-related allowances, your personal allowance is a little different.

Furthermore, you could receive tax-free allowances for these:

- your first $1000 of earnings earned from self-employment

- the first $1000 of income from the rental property

How do we apply for Personal Allowance?

You may apply for Personal Allowance in a variety of methods based the income you earn.

If you’re self-employed, and don’t have any other income sources You subtract the Personal Allowance from your earnings before determining how you’ll need to pay.

When you are determining how the amount of income tax you can deduct from your salary when you are an employee Your company (employer) will add the Personal Allowance to the amount you earn generally employing payroll software. This is done using taxes you pay.

Marriage allowance

Civil partners and married couples can request the transfer of 10% of their income tax personal allowance from each other.

Each partner must not be high-rate tax payers and cannot claim the married couple’s allowance in order to be qualified. Be aware that the recipient receives a tax cut rather than an increase in their personal allowance.

In the first year following wedding, couples are eligible for the whole benefit.

Both parties have to be born after April 6,1935.

The benefit is as high as £ 252 for couples if the other member doesn’t make use of their personal allowance in full. This amount is calculated using the personal allowance £ 12,570 + 10 percent divided by 20% equals £ 252.

Blind allowance for blind people

If you or your civil partner registered with the IRS or spouse suffer from severe impairment in sight or are blind your tax allowance is increased. When both are eligible for the allowance, both will be eligible to receive the allowance.

The additional allowance for 2022-2023 is £ 2,600. This brings your total tax allowance to £ 15,170. This is an increase over the extra allowance of just £ 2,520 for 2020-21.

If you earn less than this amount and you are not able to meet it, you can transfer the allowance of a blind person to your spouse or civil partner it functions in the same way as your marriage allowance.

Final thoughts

The points mentioned above will help you to know everything about your personal allowance. When you first enter the workforce, it might be challenging to understand how income tax works.

Understanding how income tax and Personal Allowance work will help you create a budget and determine whether you are being paid the correct amount.

ME

ME