Business organizations in UK today select outsource accounting since it offers them both cost-efficiency along with operational efficiency in financial management. Businesses no longer maintain their accounts internally since they use outsourced accounting services to conduct financial operations properly and satisfy UK tax requirements. When your business operates either as a accounting firm or a traditional established business you should consider outside accounting solutions to generate more room for essential company work.

What is Outsource Accounting?

The practice of delegating financial responsibilities to independent accounting organizations constitutes outsourced accounting. External accounting professionals can manage finances with efficiency due to outsourcing that delivers access to expert specialists. Organizations in the UK can use external accounting and bookkeeping specialists to maintain their financial documents accurately while also following HMRC guidelines. The outsourcing of financial duties for VAT returns and corporation tax filing and payroll management reduced errors and delivers superior financial accuracy to businesses.

What is Outsource Accounting?

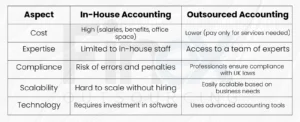

In-House vs. Outsourced Accounting

Why UK Businesses Should Consider Accounting Outsourcing

UK businesses and particularly small and medium enterprises perform increasing assessments of accounting outsourcing as it presents strategic opportunities to decrease costs while boosting operational effectiveness. Here’s why:

-

Cost Savings

A full-time employed accountant means businesses must shoulder expenses which include employee salaries and pension benefits and office space together with training costs. The elimination of overhead costs proves outsourcing investments as a more economical choice.

-

Compliance with UK Tax Regulations

Organizations must understand HMRC regulations when they plan to manage their UK tax obligations. Any wrong actions regarding tax deadlines or errors in VAT returns will lead to penalties from HMRC. Outsourcing your accounts provides access to experts who follow all essential tax laws while also knowing about deadlines including:

- Self-Assessment Tax Return Deadline: 31st January

- Corporation Tax Deadline: 9 months after the end of the accounting period

- VAT Returns Deadline: Usually every quarter

-

Access to Expert Financial Insights

Through detailed financial reporting services outsourcing partners enable business owners to obtain necessary data for making well-informed choices. The latest cloud-based accounting programs including Xero and QuickBooks help outsourced accounting companies track financial data in real-time.

Key Benefits of Outsourcing Accounting Services

Outsourcing your accounting and bookkeeping needs comes with several advantages, making it a preferred choice for many UK businesses. Here are the key benefits:

-

Reduced Operational Costs

Cost reduction represents one of the main advantages when business operations are outsourced. When your company chooses to hire an accountant in-house you will need to pay for employee compensation along with benefits and office bills and the program expenses. The payment model for outsourced accounting allows businesses to only spend what they require which reduces overall financial burden.

-

More Time for Core Business Activities

Business owners who operate small or large ventures must spend significant time on account management. The outsourcing process allows you to redirect your time toward key business goals which include business expansion and improved customer satisfaction and higher profits.

-

Increased Accuracy and Compliance

Tax laws and financial regulations in the UK are constantly evolving. A small accounting error can lead to penalties from HMRC. Outsourcing to experienced professionals ensures accuracy in accounting and bookkeeping, keeping your business compliant with UK regulations.

-

Scalability and Flexibility

The outsourcing of accounting tasks allows business of all sizes to seek specific services that suit their current operational needs. Your business expansion will not be burdened by employee hiring needs since outsourced services automatically grow together with your company.

-

Access to Advanced Technology

The latest cloud-based accounting software Xero, QuickBooks and Sage are available to numerous outsourcing firms. Financial tools grant real-time data viewing and execute bookkeeping operations automatically while providing protected data storage facilities.

How to Choose the Right Accounting Outsourcing Partner?

When outsourcing your accounting tasks, selecting the right partner is crucial. Here’s what to look for:

-

Industry Experience and Expertise

Choose an outsourcing provider with a proven track record in outsourced accounting for UK businesses. Ensure they are familiar with UK tax laws and compliance requirements.

-

Compliance and Security Measures

Your financial data is sensitive, so security is a top priority. Make sure the outsourcing firm follows strict data protection policies, including GDPR compliance, and uses secure accounting software.

-

Transparent Pricing

Look for a provider that offers clear pricing with no hidden fees. Some firms charge fixed monthly rates, while others may have flexible pricing based on the services you require.

-

Technology and Software Compatibility

Ensure that the outsourcing firm uses accounting software that integrates well with your business operations. Cloud-based platforms like Xero and QuickBooks allow seamless collaboration between you and your outsourced accounting team.

-

Client Reviews and Testimonials

Check online reviews, client testimonials, and case studies to evaluate the firm’s reliability and performance. A reputable accounting outsourcing provider should have positive feedback from businesses similar to yours.

Common Myths About Outsourced Accounting

Many UK businesses hesitate to outsource due to misconceptions. Let’s debunk some common myths:

Myth 1: Outsourcing Means Losing Control Over Finances

Fact: A good outsourcing partner provides regular financial reports, ensuring transparency and control over your accounts.

Myth 2: It’s Only for Large Businesses

Fact: Many small and medium-sized businesses in the UK outsource their accounting and bookkeeping to reduce costs and improve efficiency.

Myth 3: Data Security is a Concern

Fact: Reputable outsourcing firms use encryption, secure servers, and GDPR-compliant practices to protect your financial data.

Conclusion

Organisations in the UK benefit from accounting service outsourcing by reducing costs and increasing operational effectiveness while achieving full compliance with tax requirements. Every company from startups to established organizations benefits from outsourced accounting to improve their financial systems and pursue business expansion.

Businesses that select the appropriate accounting outsourcing partner receive expert financial management in addition to cost reductions along with improved serenity. It is beneficial for businesses to investigate outsourcing their accounting functions since this is the ideal moment to examine multiple advantages.

ME

ME